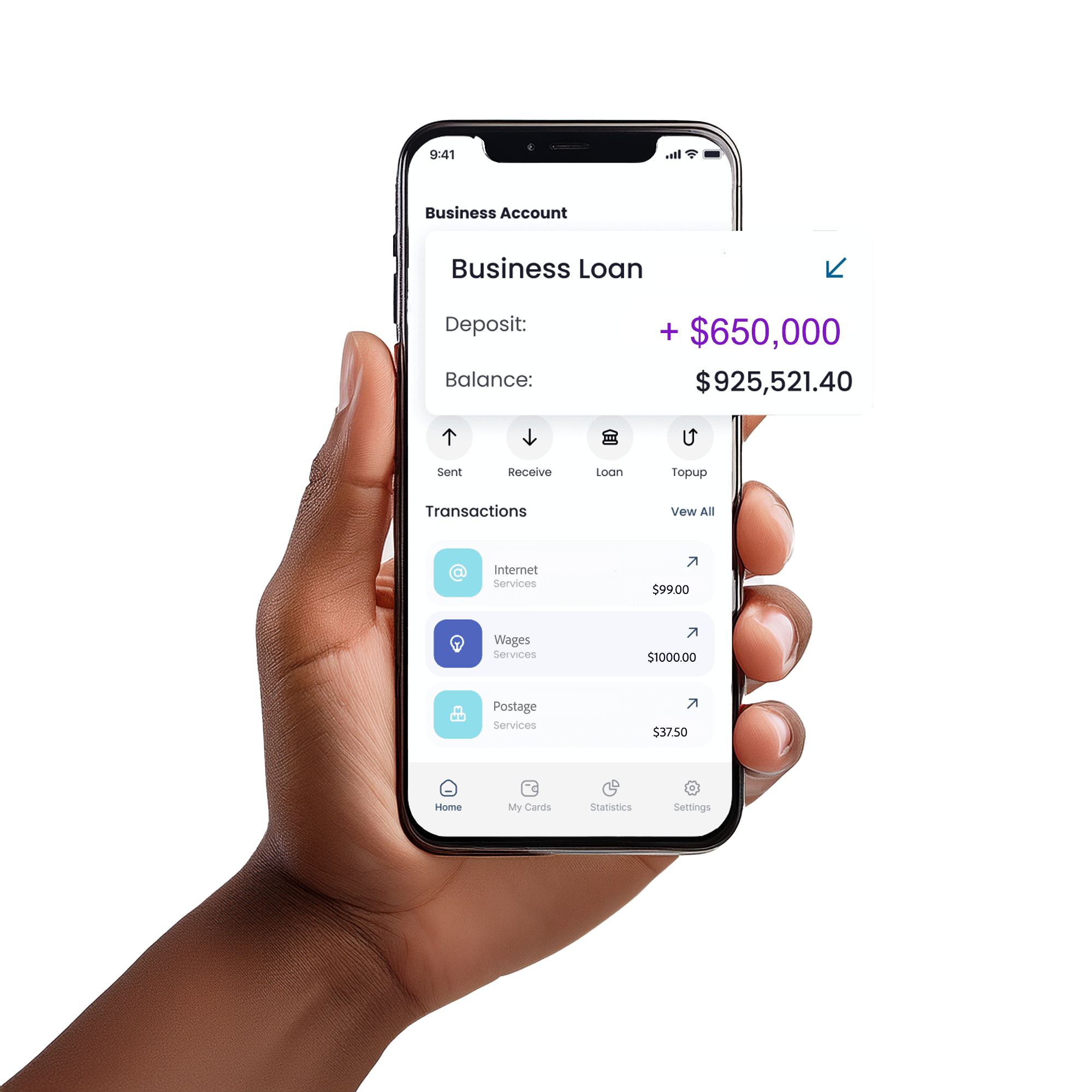

Business Finance & Loan Matching in Just 5 Minutes - No Credit Score Impact.

Stop wasting time searching for the best loan rates. No guesswork. No hidden fees. Just transparent, real-time offers from 150+ trusted lenders — with funds in your account within 24 hours

235,000 +

Customers Combined Businesses Funded

150+

Lenders To Compare From

$1.7B+

Combined Amount Settled For Businesses

200+

Years Of Experience

Partner Awards

Tailored finance to fit all your business needs

Our lenders offer award winning finance solutions and a range of business lending and cash flow options to help your business succeed.

Award Winning Powerful AI matching Technology

At Loans Guide Australia, we’ve reimagined the way Australians find finance. Our award-winning AI compares loans in real time as you enter your details, giving you instant access to the options that truly fit your needs.

Within seconds, you’ll see transparent, tailored results with no impact on your credit score. In just minutes, you can apply directly with trusted lenders—meaning approvals can be up to 50% faster than traditional methods.

Whether you’re looking for a business loan, invoice finance, or funding for growth, our platform puts the power back in your hands. With access to more than 150 lenders nationwide, we make it simple, stress-free, and secure to find the perfect loan.

Your loan is only a few clicks away.

Some of our partners

Faster Approvals. Smarter Loan Matches. Real Growth for Your Business

Access to 150+ trusted lenders and brokers, you can compare side-by-side and choose the loan that truly fits your needs—whether it’s a major purchase, debt consolidation, or driving your business growth.

✔ No Impact to Your Credit Score — Explore your options risk-free.

✔ Tailored to Fit Your Goals — Funding solutions built around your unique situation.

✔ Faster Approvals, Faster Growth — Apply in minutes and keep moving forward.

We make the process simple, transparent, and stress-free—so you can focus on what matters most: building your future with confidence.

The Future Of Borrowing Is Here.

The right business loan is just a few clicks away. Thousands of Australian businesses have already secured funding for cash flow, invoice finance, business expansion, and more through our trusted partners—and now it’s your turn.

With our real-time loan comparison, you can instantly explore options for equipment finance, trade finance, staff wages, marketing costs, and working capital. See rates, terms, and features side-by-side, then choose the loan that fits your goals best. Backed by expert guidance and over 150 lenders, we make approvals faster, easier, and completely stress-free so you can focus on growing your business.

Our unique approach tailors each loan to fit your specific financial needs, ensuring a seamless and personalized borrowing journey.

Recent Scenarios

Your perfect loan is just a few clicks away. Thousands of Australians have already unlocked smarter, faster funding through our trusted partners—and now it’s your turn. With expert guidance and loan options tailored to your goals, we make getting approved simple, stress-free, and on your term

1. Low Rate Second Mortgage For Fit-Out The Funding Requirement

The Problem:

The client needed assistance with attaining a non-bank loan based on a Second Mortgage Security for fit-out expenses of a new commercial premises.

Challenges with the lender:

The client could not provide any income verification documentation and was operating on a short timeline. The client also required a solution that did not impact their cash flow.

The Solution:

The broker was able to approach a non-bank lender on a no document basis to secure the funding required while capitalising the interest into the loan to assist with the client's cash flow. the lender was able to provide up to 70% LVR for a second mortgage to assist with the client's fit-out expenses with the client clearing the loan from future fit-out rebates from the landlord.

2. Rolls Royce financed for $1M

The Problem:

The client owned a successful Real Estate business and wanted a prestige vehicle for chaufferring high-value clients

Challenges With The Lenders:

With the Rolls Royce being classed as an “exotic vehicle”, this ruled out a number of lending options.

The Solution:

Working to a strict purchase deadline, and with the sale stalling, one of our lending partners was able to settle the deal with no additional security.

The purchase was completed within the client’s time frame, and on a 5 year term with a 35% balloon, staying under the client's repayment limit.

3. Commercial fit-out requiring a second mortgage

The Problem:

The client was after finance secured on a second-mortgage for a complete commercial fit out, that didn't impact cashflow.

Challenges With The Lenders:

The Client was unable to provide any income verification documentation and was working to an extremely tight deadline.

The Solution:

One of our lending partners secured a no-doc loan through a non-bank lender, capitalising the interest into the loan to assist with the client’s cash flow requirements

the lender was able to get the client an interest rate of 15.05% with up to 70% LVR for a second mortgage to assist with the client’s fit-out expenses, with the client clearing the loan from future fit-out rebates from the landlord.

4. 180K working capital loan for a dental practice

The Problem:

The client had been running a dental practice for 9 years, making $60K turnover per month and needed to refinance multiple existing debts (including $70K of outstanding ATO debt), the client also wanted to purchase new supplies and equipment to support the growing practice.

Challenges With The Lenders:

Banks were hesitant to offer a loan with an unpaid debt with the ATO.

The Solution:

After workshopping the deal with a few lenders, Valiant was able to secure an an out-of-policy approval for a $180K business loan over a 24-month term.

5. 100% Leveraging Property For Shareholder Buyout

The Problem:

The client needed to secure a loan exceeding $500,000 for a shareholder buyout and had an extremely tight window to finalise the deal.

Challenges With The Lenders:

Whilst the client was open to using their home as collateral, they had already borrowed up to 80% of their home’s value, which meant additional financing from their current bank was unattainable.

Alternative loan options explored by the referrer that were not tied to the home came back with interest rates above 10% and difficult repayment terms — both unacceptable to the client.

The Solution:

After referring the scenario to one of our broker partners the client was able to find and engage a lender that agreed to finance up to 100% of the home’s value without requiring lenders mortgage insurance, securing a 7.99% interest rate and a 30-year repayment term.

6. Goodwill Practice Funding When Banks Say No

The Problem:

The client, a sole trader in a physiotherapy practice, wanted a $250,000 loan to acquire a minority share in the practice, but had no available collateral and no deposit.

Challenges With The Lenders:

Traditional medical lenders like ANZ Health and BOQ Specialist advised the referrer that the client couldn’t afford to take out another loan, due to a high amount of existing debt on the client's residential properties.

The Solution:

After referring the scenario to one of our expert brokers, the client was able to engage a specialised non-bank lender willing to think outside the box to get the deal done.

The lender was able to provide 100% of the requested loan amount with a 15-year repayment term at a 9.3% annual rate.

The lender focused solely on the physio practice’s earnings to assess loan affordability, enabling the deal to meet the required profile to be successful.

7. Day ABN deal: $117k for a dump truck

The Problem:

The client had six years experience driving trucks in asbestos removal for a company as a PAYG employee and was ready to start subcontracting. To get started he needed the equipment to secure the contract. He was looking to buy a Mercedes A180 rigid site dump truck for $147k

Challenges With The Lenders:

The clients ABN was only 2 weeks old.

The Solution:

He brought with him a $30k deposit, so one of our lending partners was able to find a loan for the remaining $117k to be repaid over 5 years using work source letters and cash flow projections. The deal was approved in ten days.

Need Answers? Dive Into Our Latest Blog Posts

We're fiercely committed to ensuring you're never left in the shadows when it comes to Finance. Whether you're igniting the spark of a new startup or steering a business with decades of legacy, need a consolidation loan or a home loan, simply dive into our blog! We're sure that every answer, insight, and spark of inspiration you need awaits you here.

©Loans Guide Australia | ABN 88 561 355 320

At Loans Guide Australia, we're dedicated to helping Australians find the right financial partners. While we aim to guide you, it's important to understand that we don't offer credit or bespoke financial advice. Our suggestions are general, so always consider your unique financial needs. We don't act as a direct credit provider, and our mentions of credit products are informational, not endorsements. Before making any commitments, please familiarize yourself with the Product Disclosure Statement (PDS) and Target Market Determination (TMD). For detailed information on PDS and TMD, kindly contact the product provider. And while we simplify the online application experience, we don't directly issue loans. We are a loan referer. Please note that the time frame for loan settlements can vary and not every application will be successful.